south dakota property tax records

Any person may review the property assessment of any property in South Dakota. Public Property Records provide information on land homes and commercial properties including titles property deeds mortgages property tax assessment records and other.

Property Assessment Oglala Lakota County South Dakota

This office is a storage facility for a host of local documents.

. View the Full Range of County Assessor Records on Any Local Property. In the year 2011 property owners will be paying 2010 real estate taxes Real estate tax notices are mailed to property owners in. Enter the Address Here.

Convenience fees 235 and will appear on your credit card statement as a separate charge. Ad Search Property Tax Records from Home Without Lines or Paperwork. Enter only your house number.

South Dakota has 66 counties with median property taxes ranging from a high of 247000 in Lincoln County to a low of 51000 in Mellette County. A South Dakota Property Records Search locates real estate documents related to property in SD. Find My Tax Assessor.

Codington County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Codington County South Dakota. Search For Title Tax Pre-Foreclosure Info Today. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000.

Public Property Records provide information on land homes and commercial properties in Sioux Falls including titles property deeds mortgages property tax assessment records and other. The states laws must be adhered to in the citys handling of taxation. There are 64 Assessor Offices in South Dakota serving a population of 855444 people in an area of 75791 square miles.

1 be equal and uniform 2 be based on present market worth 3 have a single. They are maintained by. Brookings County Equalization Office.

An individual will receive instructions and assistance on the Index books. See Property Records Tax Titles Owner Info More. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

If your taxes are delinquent you will not be able to pay online. There is 1 Assessor Office per 13366 people and 1. Look up statements online.

Use our free South Dakota property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent. Send completed forms to. ASSESSMENT NOTICE VIA EMAIL FORM.

Tax amount varies by county. Taxation of properties must. ViewPay Property Taxes Online.

Assessor Director of Equalization. Dakota County Property Taxation Records. The South Dakota Property Tax Division maintains information on property taxes including real property taxes in South Dakota.

If you are unable to visit our office a last document search request may be made by email or phone and will be. Property assessments are public information. 128 of home value.

Go to the Property Information Search. Up to 38 cash back Property Tax Records. The Pennington County Equalization Department maintains an.

Search Any Address 2. Be Your Own Property Detective. Please call the Treasurers Office.

Search Brookings County property tax and assessment records by name address parcel ID and parcel map. State Summary Tax Assessors. The county register of deeds office can most appropriately be thought of as a library of local records.

Real estate taxes are paid one year in arrears. You can look up current Property Tax Statements online.

Property Tax South Dakota Department Of Revenue

Dakota County Mn Property Tax Calculator Smartasset

Property Tax South Dakota Department Of Revenue

South Dakota Property Tax Calculator Smartasset

Understanding Your Property Tax Statement Cass County Nd

Property Tax Definition Property Taxes Explained Taxedu

Understanding Your Property Tax Statement Cass County Nd

Property Tax South Dakota Department Of Revenue

Mchenry County North Dakota Departments

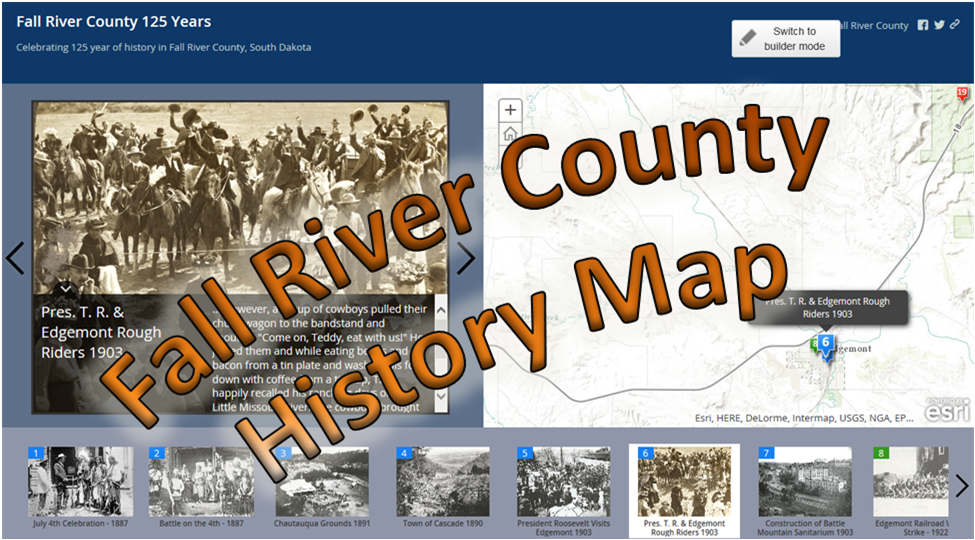

Fall River County South Dakota 906 N River Street Hot Springs Sd 57747

Property Tax Comparison By State For Cross State Businesses

Minnehaha County South Dakota Official Website

Pandora Papers Reveal South Dakota S Role As 367bn Tax Haven Us News The Guardian

Mchenry County North Dakota Departments

Assessment Freeze For The Elderly Disabled South Dakota Department Of Revenue

Property Tax South Dakota Department Of Revenue

South Dakota Property Tax Calculator Smartasset